S&P, Moddy”s and Ficht: the holy financial trio

- The economic crisis has highlighted the monopoly that exists between risk rating agencies: Standard & Poor’s (S&P), Moody’s and Ficht. They are controlled by economic interests that are far from Europeans, and in Europe, the need for a local agency has already begun to be discussed.

The financial and economic crisis generated in 2008 in the Basque Country, Europe and the planet in general has brought us serious problems both in the labour and social spheres. Radios, TV and the press shake us every day talking about risk rating agencies or rating agencies. What are these agencies? What do they do? And who are they behind them?

The opinions of these agencies on the debt of companies and countries, which are not always objective and, in some cases, completely blurred, have led to the destabilisation of many organisations. There are the cases of Enron, Lehman Brothers and the Icelandic banks. These agencies gave them good notes, but they sank. The last case, the one that turned the world around at the end of August, was the rating of the U.S. economy by the agency Standard & Poor’s (from AAA to AA+).

There has been intense debate on the other side of the ocean and, incidentally, Washington has launched an investigation against S&P for its responsibility in the area of litter mortgages. S&P dares to blow the world’s first economy, a sign of its power. Perhaps that is why there is already talk in Europe of the need to create an agency of its own to escape the claws of those super companies that so many headaches are giving.

Only companies that value the risks?

According to Wikipedia, rating agencies, or credit rating agencies, are companies that qualify specific financial products; they also note the assets of other companies, states and regional governments if the customer so requires.

With these notes, they value the creditworthiness of the donor and the risk of non-payment. They use econometric models composed of different variables (accumulated debt, rate at which the debt is settled). These data serve to analyze the economic capacity of a subject. In other words, these data show whether investing in a particular financial product (treasury bills, bonds, stocks…) is dangerous, and they measure the investor’s chances of collecting interest and recovering money when the product is finished.

Investors, donors, investment banks, intermediaries, governments ... They are the ones that most use credit risk assessments. For investors, these agencies extend the range of business possibilities and offer easy-to-use risk measurement devices. Normally, when an entity wishes to issue debt or apply for funding, it orders an agency to examine itself. This initiative aims to “help” investors and providers to set an appropriate interest rate. That is precisely why, in the days when countries issue debt, rating agencies usually publish the notes of those countries.

Oligopoly

While there are around 74 rating agencies in the world, the sector is controlled by an oligopoly made up of three New York companies: Standard & Poor’s (USA), Mooddy’s-Mooddy’s Investor Service (USA) and Fitch-Fitch-Rating (USA and UK). In their hands are 90% of the market. In addition, China’s rating agency Dagong Global Credit is important.

According to Frank Partnoy, a professor at the University of San Diego EE.UU, the regulations created around these agencies have completely erased their competition and forced market players to use only the services of those three major companies. After Black Monday of October 1929, debt issuers began buying the services of these agencies. In other words, the salary of the enemy that has to pay the student, he pays himself, creating a colossal conflict of interests.

According to the US public company SEC (Security and Exchange Committee), these agencies have done what other companies had already done: “In the previous decade they gave qualifications that were absolutely false, and it was precisely the years that got the most benefits.” To overcome this problem, different proposals have been made. Some call for the simple removal of the rigid rules on agencies to air the market. But, of course, the privileged companies do not look favourably on this measure, and as an alternative, they have offered to take measures that would lead to an increase in the market price.

They're journalists, not economists.

Curiously, rating agencies are not officially recognised as financial institutions or economic associations. To avoid problems, they are registered as press agencies. That is, they only perform information tasks. They are therefore not subject to the rules of audit firms; in audits the transparency of reports must prevail and respond to their assets in the event of unforeseen bankruptcy. On the contrary, when Lehman Brothers closed its doors in 2008, rating agencies did not pay a penny of this kind of krak.

Rating agentziak ez dira inuzenteak, ezta neutralak ere. Haien atzetik interes ekonomiko eta finantzario zehatzak daude, eta bakoitzaren kapital eraketak erakusten du hori. Zein dira interes horiek? Ikus dezagun nola dauden osatuak AEBetako hiru konpainia nagusiak.

Standard & Poor’s ehuneko ehunean kontrolatzen du McGraw-Hill talde editorial erraldoiak, batez ere enpresa munduko hezkuntza eta kudeaketari buruzko liburuak publikatzen ditu talde horrek. Fich-Rating-en %60a Frantziako Fimalac enpresaren esku dago; burtsan kotizatzen du eta Marc Ladreit Lacharrière enpresari ezagunaren jabetzakoa da. Beste %40 Hearst enpresaren esku dago, besteak beste Esquiere, Elle eta Cosmopolitan aldizkarien argitaratzailea. Moddy’s-eko kapitala anitzagoa da: %12,5 Berkshire Hathaway-k du, Warren Buffet milioidunaren enpresa; %12,4 Capital World Investor-ek kontrolatzen du; eta %6 Rowe Price inbertsiogileen konpainiak. Gainerako guztia inbertsio funts askoren artean banatzen da.

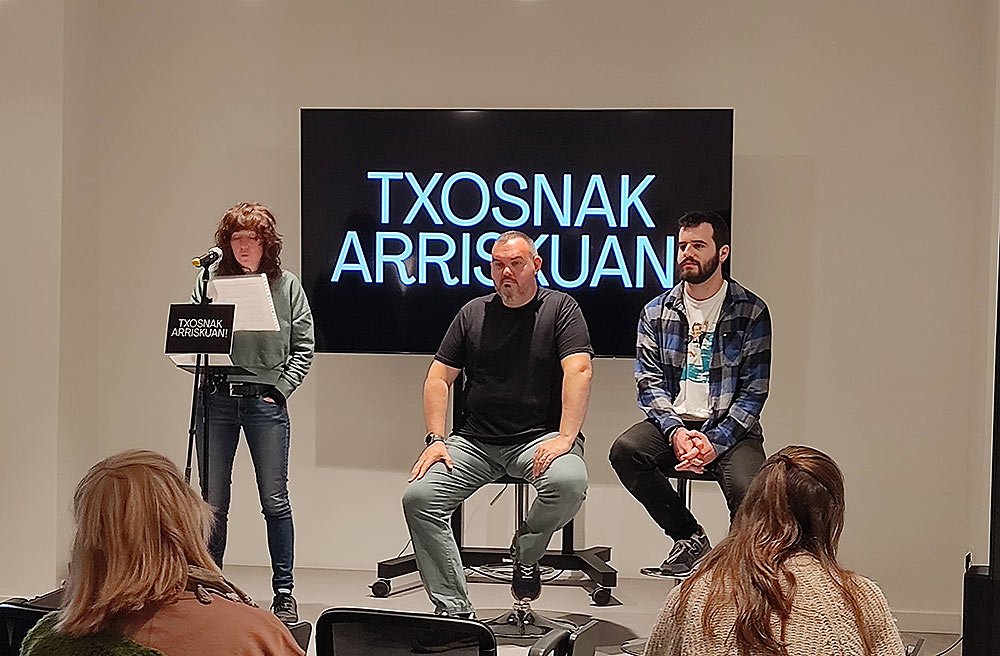

BRN + Neighborhood and Sain Mountain + Odei + Monsieur le crepe and Muxker

What: The harvest party.

When: May 2nd.

In which: In the Bilborock Room.

---------------------------------------------------------

The seeds sown need water, light and time to germinate. Nature has... [+]